Our Operating Environment

As the flagship university of the State of Vermont, UVM is accountable to its citizenry and government for truthful and transparent disclosure of its financial condition. As a key driver of academic, social, and economic progress within Vermont, UVM is responsible for exemplary leadership in business ethics, including integrity of financial reporting and the progressive management of risk to assure the financial health and wellbeing of the institution.

The University is required to follow certain standards, including those issued by the Governmental Accounting Standards Board (GASB), and the laws, regulations, and standards of the State of Vermont and United States.

UVM also aspires to follow best practices developed by relevant financial and higher education industry professional associations, such as the National Association of College and University Business Officers (NACUBO), Association of College and University Auditors (ACUA), Committee of Sponsoring Organizations of the Treadway Commission (COSO), American Institute of Certified Public Accountants (AICPA), and the University Risk Management and Insurance Association (URMIA).

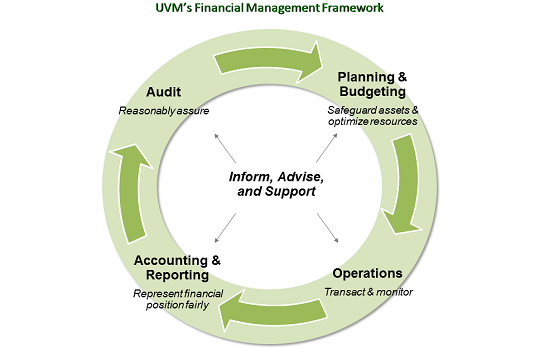

Our Financial Management Framework

The University’s financial management framework has five major components that take place on an annual cycle:

Our Services

The Division of Finance supports the University's goals for academic excellence by providing a wide range of financial services to the University of Vermont community .