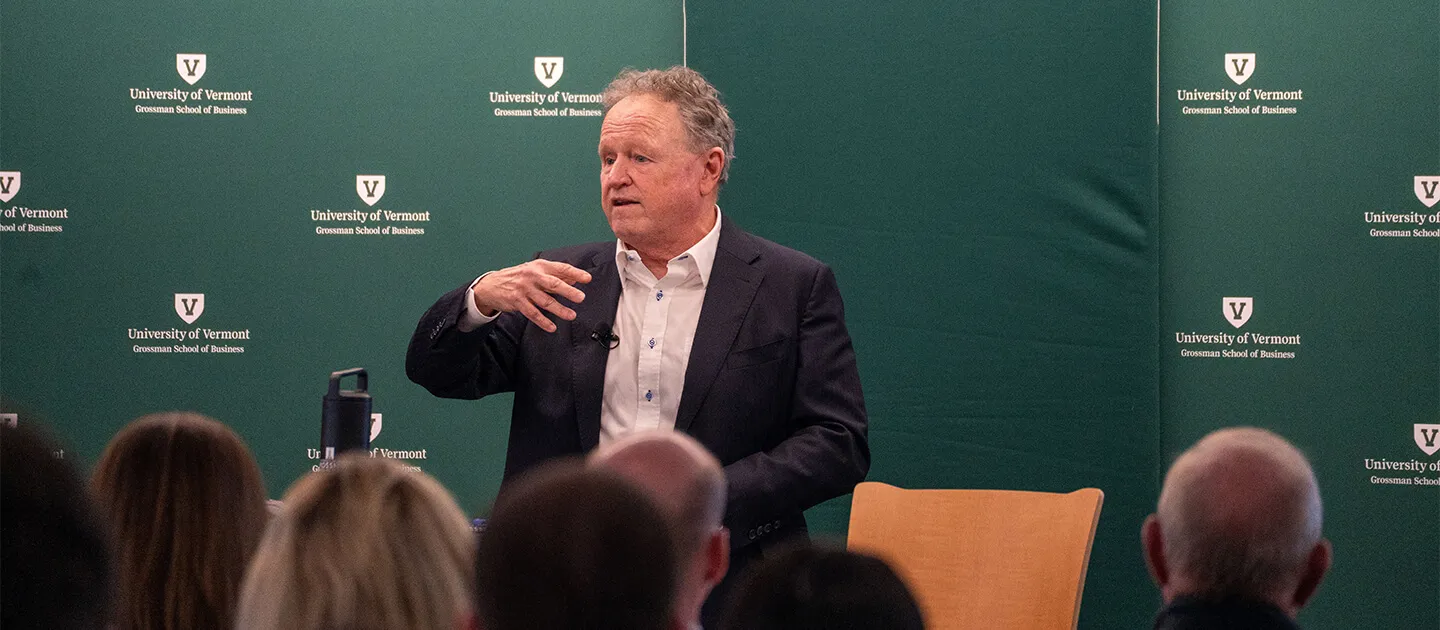

Greg Hunt ’79, managing director at Apollo Global Management, returned to the University of Vermont this April as the featured speaker for the 13th annual Hoffman Family Business Lecture, a series that provides students the opportunity to learn about innovative business policies and practices from leading scholars through special guest lectures every spring. With decades of experience leading corporate turnarounds and navigating financial market shifts, Hunt offered Grossman School of Business students a direct look into one of the most talked-about sectors in today’s economy: private credit.

Private Credit’s Momentum and Market Implications

In his talk entitled “Private Credit: The Beginning of the End, or the End of the Beginning?” Hunt explained how the financial landscape has undergone massive transformation since the 2008 recession and the implementation of Dodd-Frank regulations. These changes drove risk and capital out of the traditional banking sector and into private markets. Now, roughly 67% of U.S. financing activity flows through private credit, he says.

Hunt highlighted that while banks remain about ten times more leveraged than private equity firms, private credit has emerged as a safer, more adaptable alternative—particularly during periods of economic uncertainty. Companies are staying private longer, and investors are increasingly turning to private capital markets for dependable, long-term financing solutions. The sector’s ability to withstand today’s economic headwinds - including inflation, geopolitical tensions, and the risk of recession -demonstrates just how far it has evolved since 2008.

Lessons from a Career Navigating Volatility

Hunt’s career has been defined by managing through unpredictable financial and operational environments. Before joining Apollo in 2012, he held senior financial leadership positions at companies like Yankee Candle, Norwegian Cruise Lines, Tweeter Home Entertainment Group, and Samsonite Corporation. In each role, he led complex financial restructurings, and strategy shifts during turbulent times.

That experience shapes the way Hunt thinks about risk and opportunity today. “What don’t you have financed?” he asked the audience, pointing out that nearly every business decision now relies on some form of financing. In his view, choosing the right financial partner - and doing so in a way that balances growth, flexibility, and stability - is more critical than ever.

A Strategic Approach: The Waterfall Effect

To help students think through complicated capital decisions, Hunt introduced a personal framework he uses in his work at Apollo: the “Waterfall Effect.” In this model, a company’s value flows like water over a fall. Analysts must assess how much value “trickles down” to the bottom whether that’s cash flow, investor returns, or stakeholder outcomes. If the fundamentals are strong enough for value to reach the bottom, Hunt believes that’s when the company is worth engaging with.

Hunt left the audience with a lasting framework for approaching uncertainty and one that challenges future business leaders to think critically, act strategically, and stay grounded in fundamentals as they navigate what’s next.

About the Author

Caroline Fox ’25 is an intern in the marketing and communications department at the University of Vermont’s Grossman School of Business, where she holds a concentration in marketing and a global business theme. She has held multiple leadership roles on campus, including president of the Catamount Innovation Fund and senior lead coordinator for the Schlesinger Global Family Enterprise Case Competition (SG-FECC). With a passion for communications, event planning, and strategic storytelling, she is dedicated to helping amplify the voices of industry leaders and connect students to real-world insights.

Photos: Elizabeth Smith