UVM News brings you the University of Vermont’s top stories, showcasing breakthrough research, timely solutions and experts, and news from Vermont’s flagship university.

Featured News

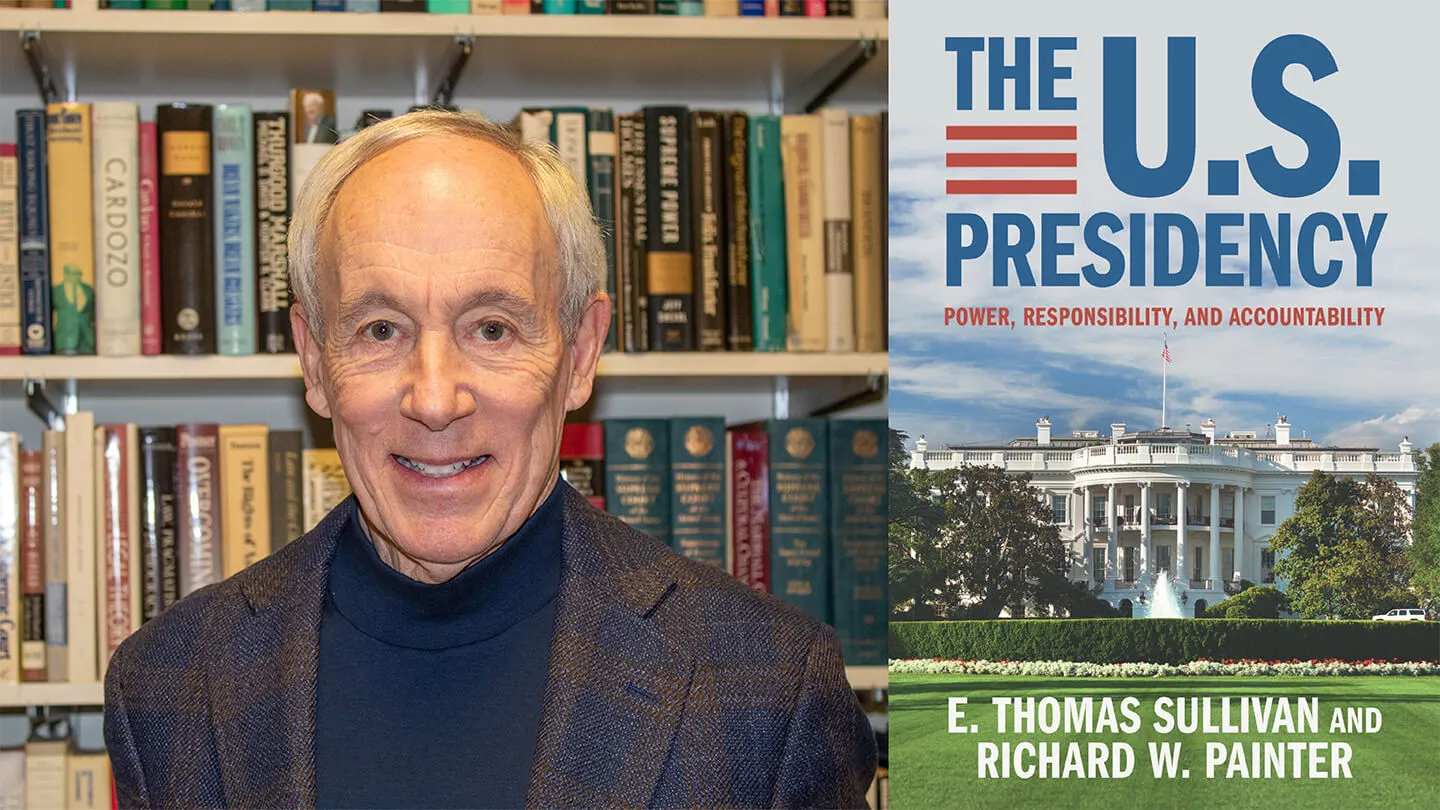

The Transformation of Presidential Power: Examining the U.S. Presidency through Law, Politics, and History

Tough Together: How UVM Men’s Rugby Became National Champions

A Legacy in Leaves: Pringle Herbarium Honors 95-Year-Old Hilda White with a Holly Fern That Will Carry Her Name Forever

Canadian Wildfire Smoke Worsened Pediatric Asthma in U.S. Northeast: UVM Study

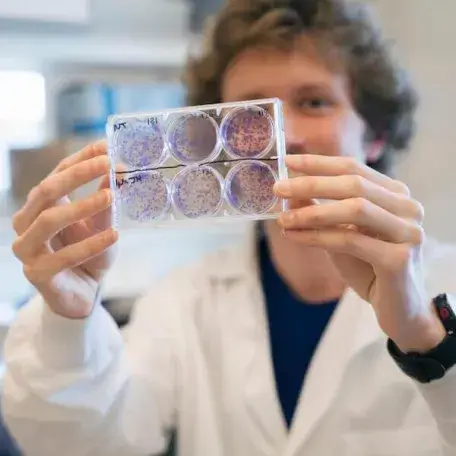

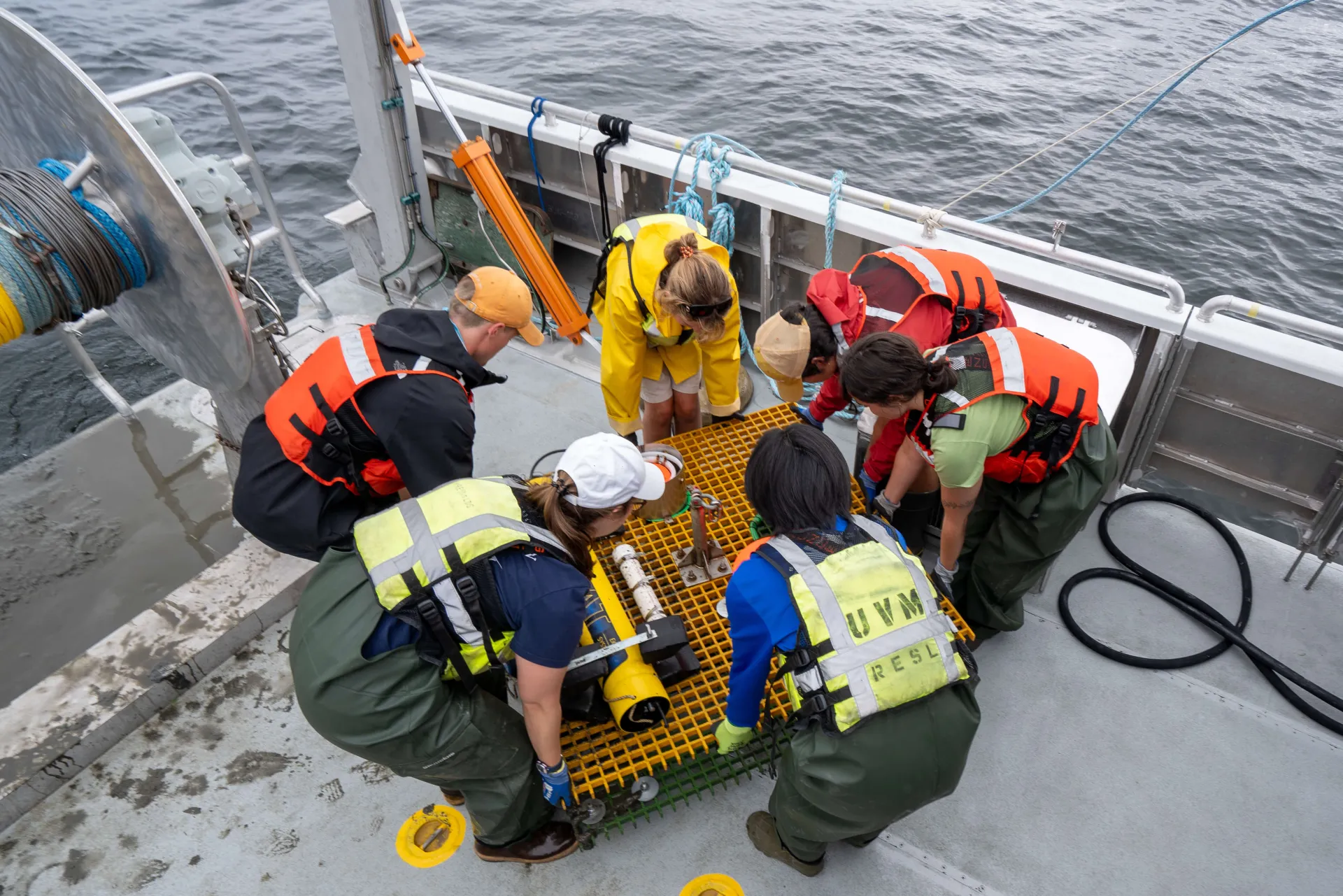

UVM’s Leahy Institute Awards $2.5M to Vermont Organizations Targeting Childhood Asthma, Clean Water Microbots, Biotech Innovators