Solutions to HW4

Economics 172

Spring 2005

Homework 4

Due Wednesday Feb 16

Review questions

4.2

4.9

4.10

4.17

4.20

4.27

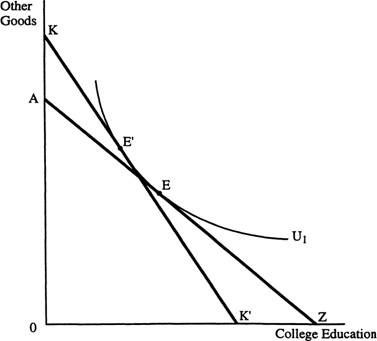

4.2 If the price of one unit of college education rises and the

price of all  other goods (the composite good) falls, the

consumer could (but does not always have to) be on the same indifference curve.

The old budget line was AZ and the new

one is KK’. If the consumer on the same indifference curve,

she will never buy the same market basket as she did before (at point E).

other goods (the composite good) falls, the

consumer could (but does not always have to) be on the same indifference curve.

The old budget line was AZ and the new

one is KK’. If the consumer on the same indifference curve,

she will never buy the same market basket as she did before (at point E).

The new marginal

rate of substitution at point E’ is higher than it used to be at point E, since

the consumer will change her optimal consumption bundle to reflect the new

relative prices (that is the slope of the new budget line, which is Ped/Pog). So the consumer will always buy more other

goods and less education.

4.9 a. This is a good question to show the interactions between

micro and statistics (actually econometrics). The demand equation is

Qi = a + bPi + cIi +

dPPAYi + ei . And

you are given that b = -230.0 c = -0.01 d = -99.5

The average

monthly per capita income is $6,677.40 and the number of subscribers is 5,370.

The income

elasticity of demand

for basic cable service is (% Ch Qd/% Ch Income) which is (ChQd/ChInc)(I/Q)

Ch Qd/Ch Inc is c

which is -.01 so the income elasticity is (-.01)(6677/5370)

= -.012 This means that cable is an

inferior good (since its sign is negative).

However, the actual number is very small (that is, close to zero) and we

would have to know the statistical significance of the coefficient in order to

determine whether it is valid.

b. The cross price elasticity of demand for basic service with

respect to the pay tier price:

%Ch Qd of cable /

% Ch Pay Tier Price Evaluated at the average values:

(Ch Qd/Ch Pay Tier

price) (Pay Tier Price/Qd Basic Cable)

The Ch Qd cable/Ch Pay tier price is d which is -99.5 and Pay Tier Price

/ Qd Basic cable is $13/5370 . So -99.5 (13/5370) = -0.24 Since the cross

price elasticity is negative, the two products are complements.

c. The income elasticity of demand for basic service evaluated at the

income and quantity data for system 3:

(% Ch Qd/% Ch Income) which is (ChQd/ChInc)(I/Q) but this time we substitute in the values for system

3 for I/Q or 8900/3900

So the elasticity

is (-.01)(8900/3900) = -0.023. This is also a negative number so the income

elasticity shows that it is an inferior good for system 3.

4.10 If butter and butcher knives are both inferior, then the only

other good Lorena consumes must be a normal good. Her income goes up and she’s spending more on

butter knives and butcher knives. She

must spend more on steak knives.

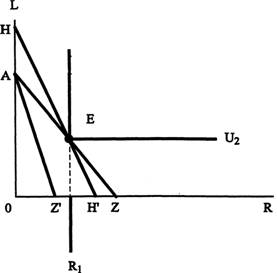

4.17 Left and right shoes are perfect complements. If the price of right shoes goes up,  there is no substitution effect. Even though left shoes are now cheaper, you

must use left and right shoes together so you can’t substitute away from right

shoes and buy more left shoes. The

budget line shifts from AZ to AZ’ To analyze the substitution effect, we

push budget line AZ’ outward until it is tangent to the original indifference

curve. There is no substitution effect,

since we stay at point E

there is no substitution effect. Even though left shoes are now cheaper, you

must use left and right shoes together so you can’t substitute away from right

shoes and buy more left shoes. The

budget line shifts from AZ to AZ’ To analyze the substitution effect, we

push budget line AZ’ outward until it is tangent to the original indifference

curve. There is no substitution effect,

since we stay at point E

There is only an

income effect, which brings the consumer from R1 right shoes to something less

(an indifference curve tangent to AZ’).

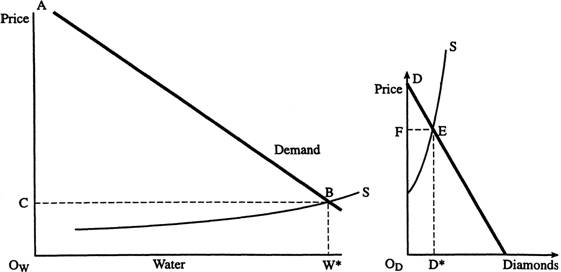

4.20 As we discussed in class, this problem is

known as the water-diamond paradox. The solution to the paradox is to

distinguish between total value and marginal value. Because the supply of water

is large relative to demand, while the supply of diamonds is low relative to

demand, the market price for diamonds is higher than the market price for

water. The market for water is in the graph on  the left below and the market for diamonds

in the graph on the right. The large demand for water intersects the large suply of water, generating a low price,

C, while the demand and supply for diamonds are both much less than those for

water, yet the price is high, F. These prices measure the marginal value for

water and diamonds respectively. But, the total value for water, which is the

the left below and the market for diamonds

in the graph on the right. The large demand for water intersects the large suply of water, generating a low price,

C, while the demand and supply for diamonds are both much less than those for

water, yet the price is high, F. These prices measure the marginal value for

water and diamonds respectively. But, the total value for water, which is the

area ABW OW is

much larger than the total value for diamonds, which is the area DED OW. Further, consumer surplus is much

greater for water than diamonds—area ABC versus area DEF.

4.27

The answer is

uncertain. The income effect can be

greater, less than, or equal to the substitution effect. It depends on how much hamburger consumption

falls in the wake of a price increase. What is known for sure, however, is that

hamburger is not sufficiently an inferior good to the consumer so that the

positive income effect associated with the price decrease ends up outweighing

the negative substitution effect (if the latter were indeed the case,

consumption would rise in the wake of the price increase).