Economics 172

Fall 2007

Due Friday October 26

Homework 7

Chapter 8

Questions 2, 6, 8, 11, (You do not need to draw graphs for any of these in your answers, although you will need to think about average costs and doodle around with them to answer them correctly.)

2. Suppose the marginal cost curve hit the

price line at 2 different output levels .

If the MC curve is decreasing and it crosses the price line, by

increasing output, MC would be falling and would be less than price. The firm should expand.

When the MC curve

is rising and crosses the price line, if it produced more MC would be higher

than price. The firm should not expand

production.

Using

calculus: Π(q) = R(q) – C(q)

Differentiate with

respect to q: Π’(q) = R’(q) – C’(q) where ’ means first

derivative.

Profit

maximization requires Π’(q) = R’(q) – C’(q) = 0 or R’(q) =

C’(q)

Now take the

second derivative: Π’’(q) = R’’(q) – C’’(q)

Remember from

calculus that a relative maximum occurs when f’’(x) < 0 and a relative

minimum is when f’’(x) >0; that is, the function is at a relative maximum if

the second derivative is negative and a minimum if it is positive.

So if R’’(q) -

C’’(q) < 0, then profits will be maximized. So when is R’’(q) <

C’’(q) ? When the rate of change of MR is less

than the rate of change of MC. When MC crosses MR or price when MC

is rising, then R’’(q) =0 and C’’(q) >0.

6. The French government gives cheese producers

a fixed amount regardless of how much cheese they produce. This is like a reduction in fixed costs. Firms in

The answer to this problem is similar to

Solved Problem 8.3 in the text, except it works in reverse.

11. If

1. The ballpoint pen industry is a competitive industry in long run equilibrium and all pens sell for $2.

a. Assume that all firms have normally shaped average and marginal cost curves. Show, using all relevant graphs the initial long run equilibrium situation for a representative firm in the ballpoint pen industry. Be sure to show output level and all relevant costs.

Ballpoint pens are manufactured in numerous factories all

over the

b. Show graphically and briefly discuss how this tax will

affect the market price and quantity of ballpoint pens in the

c. Show and briefly discuss how this tax will affect the price, quantity, and profits of ClevePens in the short run.

Output will fall

from q1 to q2. The price ClevePens can charge in the market is unchanged because it

is in a competitive market. Profits

will fall and be negative since AC>Price.

d. Show graphically and briefly discuss how this tax will affect the price, quantity, and profits of ClevePens in the long run.

2. (15) 7. Overheard in a restaurant: “My firm loses $2 on each unit of output we produce. But we produce so much that we make up for that loss in volume. Consequently we earn profits.” Comment on the economic validity of this statement using graphical and verbal analysis.

If the P<ATC by

$2, the firm is losing $2 on each unit of output. Total profit must be average profit times the

number of units produced, Q. Q x -$2

must be negative. The guy in the

restaurant doesn’t know what he’s talking about. Graphically, it is part b of

the above question.

Chapter 9 questions.

Questions 2, 6, 11

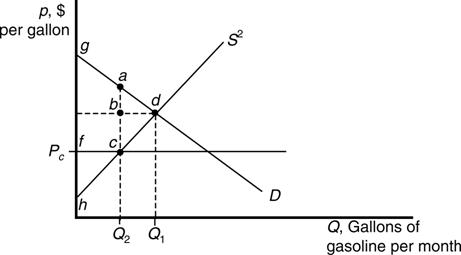

2. The initial consumer surplus is the area

bounded by gd and then over

to the vertical axis and up to g. The

initial producer surplus is from d to h and up to where the dotted line

intersects the y axis.

The new consumer

surplus is gacf and producer surplus is fch.

The

price ceiling (pc) on gasoline reduces welfare by the areas abd + bcd.

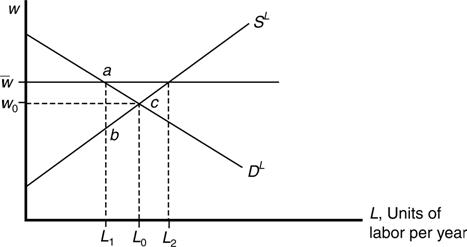

6. The welfare loss due to the minimum wage is area abc. When the minimum is instituted, employment falls to L1 from L0. Because labor supply at the new higher wage increases to L2, unemployment is increased by the institution of the minimum. Because of the excess supply, less experienced workers are likely to be losers with the new policy. In addition, if discrimination exists on the basis of age, gender, or race, those workers in the less desired group are also likely to be hurt by the minimum wage. Initial consumer surplus is wocw (w is where the D curve intersects the vertical axis. Initial producer surplus is woc to where the S curve intersects the y axis. The new consumer surplus is ŵaw and producer surplus is ŵab to the y axis.

1. In the market for organs for transplant, such as kidneys and hearts, the price is constrained by law to equal zero. Opposition to any type of remuneration for donating organs has been all but absolute from most physicians and legislators. In no state can organs be sold or purchased. Reliance on altruism, however, does not appear to be working. (For more information about the problems that result, and how many people are waiting for transplants, go to UNOS.) Relying on graphs, explain the effect that banning the sale or purchase of human organs has on producer surplus and consumer surplus.

Under the current system,

the quantity of organs available is constrained to be Q1. If there was a market, the quantity would be

Q2. The current consumer surplus is the

triangle above the P1 line and the consumer surplus if there was a market would

be the triangle above P2.