Economics 11

Spring 2005

Due Wednesday, Feb 16, 2005††††††††††††††††††††††† Homework 4

Chapter 6 Problems and Applications

Do problems 3,† 4,† and 9

3. a. The equilibrium price is where quantity demanded equals

quantity supplied, which is at a price of $8 with 6 million produced and 6

million bought.

|

Price per Frisbee |

Quantity Demanded (millions) |

Quantity Supplied (millions) |

|

$11 |

1 |

15 |

|

$10 |

2 |

12 |

|

$9 |

4 |

9 |

|

$8 |

6 |

6 |

|

$7 |

8 |

3 |

|

$6 |

10 |

1 |

†

b.† If Congress puts a price floor of $2 above the equilibrium price

(remember, the price canít go below the floor).†

Prices cannot be any lower than $10.†

At a price of $10, only 2 million frisbees will

be sold.†

c.† †Now

Congress imposes a price ceiling of $9. ††The price canít be any higher than $9.† But the market clearing price was $8, so the

governmentís price ceiling has no effect.†

The price is still $8 and 6 million are sold.

4.† a. Here is the

initial equilibrium situation:† The price

is P1 .† Thatís

what beer drinkers pay and also what beer producers

get.†

†Now the government requires a $2 tax to be

paid on each case and beer drinkers pay the tax.†† Suppliers now receive P2-$2 and buyers pay

P2.† The equilibrium quantity of beer

purchased falls to Q2.† The difference is

the amount of the tax.

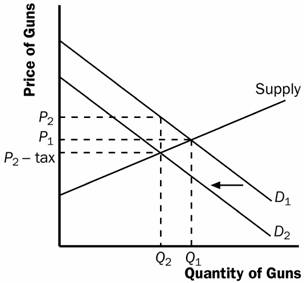

9. †a.† A tax on gun buyers will shift the demand

curve for guns to the left, reducing the quantity sold to Q2 and raising the

price to consumers (from P1 to P2) and lowering the price that gun producers

get from P1 to P2-tax.

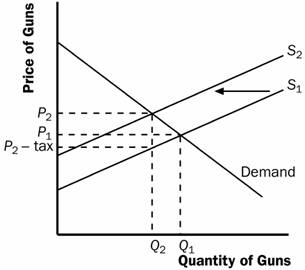

b.† A tax on gun sellers

will shift the supply curve for guns to the left, reducing the quantity sold

and raising the price to consumers and lowering the price that gun producers

get.† The result is identical to (a).

c.† A price floor on guns

above the equilibrium price, will reduce the quantity of guns bought but lead

to a surplus of guns, since producers will be producing Q3 guns and people will

be buying only Q2.

d.† A tax on ammunition

will shift the demand for guns to the left (a decrease in demand).† Thatís because guns and ammunition are

compelementary goods, and when the price of one goes up, the demand for the

complement falls.